http://www.ftc.gov/bcp/edu/pubs/consumer/idtheft/idt07.shtm

- Place a fraud alert on your credit reports, and reviews your reports

Fraud alerts can help prevent an identity thief from opening any more accounts in your name. Contact the toll-free fraud number of any of the three nationwide consumer reporting companies to place a fraud alert on your credit report. You need to contact only one of the three companies to place an alert. The company you call is required to contact the other two, which will then place an alert on their versions of your report.

- TransUnion: 1-800-680-7289; www.transunion.com; Fraud Victim Assistance Division, P.O. Box 6790, Fullerton, CA 92834-6790

- Equifax: 1-800-525-6285; www.equifax.com; P.O. Box 740241, Atlanta, GA 30374- 0241

- Experian: 1-888-EXPERIAN (397-3742); www.experian.com; P.O. Box 9554, Allen, TX 75013

Once you place the fraud alert on your file, you’re entitled to order free copies of your credit reports; if you ask, only the last four digits of your SSN will appear on your credit reports. Once you get your credit reports, review them carefully. Look for inquiries from companies you haven’t contacted; accounts you didn’t open; and debts on your accounts that you can’t explain. Check that information like your SSN, address (es), and name or initials are correct. If you find fraudulent or inaccurate information, get it removed. See the FTC’s comprehensive identity theft recovery guide, Take Charge: Fighting Back Against Identity Theft, at www.ftc.gov/idtheft to learn how. Continue to check your credit reports periodically, especially for the first year after you discover the identity theft, to make sure no new fraudulent activity has occurred.

Fraud Alerts

There are two types of fraud alerts: an initial alert and an extended alert.

An initial alert stays on your credit report for at least 90 days. You may ask that an initial fraud alert be placed on your credit report if you suspect you have been, or are about to be, a victim of identity theft.

- An initial alert is appropriate if your wallet has been stolen or if you’ve been taken in by a “phishing” scam. Phishing occurs when scam artists steal personal information from you by sending email that claims to be from a legitimate company and says you have a problem with your account. When you place an initial fraud alert on your credit report, you’re entitled to one free credit report from each of the three nationwide consumer reporting companies.

- An extended alert stays on your credit report for seven years. You can have an extended alert placed on your credit report if you’ve been a victim of identity theft and you provide the consumer reporting company with an “identity theft report.” When you place an extended alert on your credit report, you’re entitled to two free credit reports within twelve months, after placing the alert, from each of the three nationwide consumer reporting companies. In addition, the consumer reporting companies will remove your name from marketing lists for prescreened credit offers for five years unless you ask them to put your name back on the list before then.

To place either of these alerts on your credit report, or to have them removed, you will be required to provide appropriate proof of your identity, which may include your SSN, name, address, and other personal information the consumer reporting company requests.

When a business sees the alert on your credit report, they must verify your identity before issuing you credit. As part of this verification process, the business may try to contact you directly. This may cause some delays if you’re trying to obtain credit. To compensate for possible delays, you may wish to include a cell phone number, where you can be reached easily, in your alert. Remember to keep all contact information in your alert current.

The Identity Theft Report

An identity theft report may have two parts:

Part One is a copy of a report filed with a local, state, or federal law enforcement agency like your local police department, your State Attorney General, the FBI, the U.S. Secret Service, the FTC, or the U.S. Postal Inspection Service. When you file a report, provide as much information as you can about the crime, including anything you know about the dates of the identity theft, the fraudulent accounts opened, and the alleged identity thief.

Part Two of an identity theft report depends on the policies of the consumer reporting company and the information provider (the business that sent the information to the consumer reporting company). They may ask you to provide information or documentation to verify your identity theft in addition to that included in the law enforcement report. They must make their request within 15 days of receiving your law enforcement report, or, if you already have an extended fraud alert on your credit report, the date you submit your request to the credit reporting company for information blocking. The consumer reporting company and the information provider then have 15 more days to work with you to make sure your identity theft report contains everything they need. They are entitled to take five days to review any information you give them. For example, if you give them information 11 days after they request it, they do not have to make a final decision until 16 days after they asked you for that information. If you give them any information after the 15-day deadline, they can reject your identity theft report as incomplete, and you will have to resubmit it with the correct information.

Most federal and state agencies and some local police departments offer only “automated” reports – a report that does not require a face-to-face meeting with a law enforcement officer. Automated reports may be submitted online, or by telephone or mail. If you have a choice, do not use an automated report. The reason? It’s more difficult for the consumer reporting company or information provider to verify the information. Unless you are asking a consumer reporting company to place an extended fraud alert on your credit report, you probably will have to provide additional information or documentation if you use an automated report.

- Close the accounts that you know, or believe, have been tampered with or opened fraudulently.

Call and speak with someone in the security or fraud department of each company. Follow up in writing, and include copies (NOT originals) of supporting documents. It’s important to notify credit card companies and banks in writing. Send your letters by certified mail, and request a return receipt so you can document what the company received and when. Keep a file of your correspondence and enclosures.

When you open new accounts, use new Personal Identification Numbers (PINs) and passwords. Avoid using easily available information like your mother’s maiden name, your birth date, the last four digits of your SSN or your phone number, or a series of consecutive numbers.

If the identity thief has made charges or debits to your accounts, or to fraudulently opened accounts, ask the company for the forms to dispute those transactions. Also request the transaction records relating to the identity theft, such as the fraudulent credit application.

Once you have resolved your identity theft dispute with the company, ask for a letter stating that the company has closed the disputed accounts and has discharged the fraudulent debts. This letter can help you if errors relating to this account reappear on your credit report or you are contacted again about the fraudulent debt.

- File a report with your local police or the police in the community where the identity theft took place.

Then, get a copy of the police report or at the very least, the number of the report. It can help you deal with creditors who need proof of the crime. If the police are reluctant to take your report, ask to file a “Miscellaneous Incidents” report, or try another jurisdiction, like your state police. You also can check with your state Attorney General’s office to find out if state law requires the police to take reports for identity theft. Check the Blue Pages of your telephone directory for the phone number or check www.naag.org for a list of state Attorneys General.

- File a complaint with the Federal Trade Commission.

By sharing your identity theft complaint with the FTC, you will provide important information that can help law enforcement officials across the nation track down identity thieves and stop them. The FTC can refer victims’ complaints to other government agencies and companies for further action, as well as investigate companies for violations of laws the agency enforces.

You can file a complaint online at www.ftc.gov/idtheft, by phone at 1-877-IDTHEFT (438-4338); TTY: 1-866-653- 4261, or by mail: Identity Theft Clearinghouse, Federal Trade Commission, 600 Pennsylvania Avenue, NW, Washington, DC 20580. Be sure to call the Hotline to update your complaint if you have any additional information or problems.

Next, Take Control

Although identity thieves can wreak havoc on your personal finances, there are some things you can do to take control of the situation. Here’s how to handle some of the most common forms of identity theft.

If an identity thief has stolen your mail for access to new credit cards, bank and credit card statements, pre-approved credit offers, and tax information or falsified change-of-address forms, (s)he has committed a crime. Report it to your local postal inspector.

If you discover that an identity thief has changed the billing address on an existing credit card account, close the account. When you open a new account, ask that a password be used before any inquiries or changes can be made on the account. Avoid using easily available information like your mother’s maiden name, your birth date, the last four digits of your SSN or your phone number, or a series of consecutive numbers. Avoid the same information and numbers when you create a Personal Identification Number (PIN).

If you have reason to believe that an identity thief has accessed your bank accounts, checking account, or used your ATM card, close the accounts immediately. When you open new accounts, insist on password-only access. If your checks have been stolen or misused, stop payment. If your ATM card has been lost, stolen, or otherwise compromised, cancel the card and get another with a new PIN.

If an identity thief has established new phone or wireless service in your name and is making unauthorized calls that appear to come from – and are billed to – your cellular phone, or is using your calling card and PIN, contact your service provider immediately to cancel the account and calling card. Get new accounts and new PINs.

If it appears that someone is using your SSN when applying for a job, get in touch with the Social Security Administration to verify the accuracy of your reported earnings and that your name is reported correctly. Call 1-800-772-1213 to check your Social Security Statement.

If you suspect that your name or SSN is being used by an identity thief to get a driver’s license, report it to your Department of Motor Vehicles. Also, if your state uses your SSN as your driver’s license number, ask to substitute another number.

Staying Alert

Once resolved, most cases of identity theft stay resolved. But occasionally, some victims have recurring problems. To stay on top of the situation, continue to monitor your credit reports and read your financial account statements promptly and carefully. You may want to review your credit reports once every three months in the first year of the theft, and once a year thereafter. Stay alert for other signs of identity theft, like:

- Failing to receive bills or other mail. Follow up with creditors if your bills don’t arrive on time. A missing bill could mean an identity thief has taken over your account and changed your billing address to cover his tracks.

- Receiving credit cards that you didn’t apply for.

- Being denied credit or being offered less favorable credit terms, like a high interest rate, for no apparent reason.

- Getting calls or letters from debt collectors or businesses about merchandise or services you didn’t buy.

Law enforcement: Report the crime to your local police or sheriff’s department right away. You might also need to report it to police department(s) where the crime occurred if it’s somewhere other than where you live. Give them as much documented evidence as possible. Make sure the police report lists the fraudulent accounts. Get a copy of the report, which is called an “identity theft report” under the FCRA. Keep the phone number of your investigator handy and give it to creditors and others who require verification of your case. Credit card companies and banks may require you to show the report in order to verify the crime.

FTC regulations define an “identity theft report” to include a report made to a local, state, or federal law enforcement agency. If your local police department refuses to file a report and your situation involves fraudulent use of the U.S. mail, you can obtain an identity theft report from the U.S. Postal Inspector. If your case involves fraudulent use of a driver’s license in your name, you might be able to obtain a report from your state’s Department of Motor Vehicles.

The FTC works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. To file a complaint or get free information on consumer issues, visit ftc.gov or call toll-free, 1-877-FTC-HELP (1-877-382-4357); TTY: 1-866-653-4261. Watch a video, How to File a Complaint, at ftc.gov/video to learn more. The FTC enters consumer complaints into the Consumer Sentinel Network, a secure online database and investigative tool used by hundreds of civil and criminal law enforcement agencies in the U.S. and abroad.

- Federal Trade Commission. Report the crime to the FTC. Include your police report number. Although the FTC does not itself investigate identity theft cases, they share such information with investigators nationwide who are fighting identity theft.

- Call the FTC’s Identity Theft Hotline: (877) IDTHEFT (877-438-4338)

- Or use its online identity theft complaint form: https://www.ftccomplaintassistant.gov/

- Or write: FTC Identity Theft Clearinghouse, 600 Pennsylvania Ave. N.W., Washington, DC 20580.

- The FTC’s uniform fraud affidavit form is available at http://www.ftc.gov/bcp/edu/resources/forms/affidavit.pdf

- Visit the Web site for the President’s Identity Theft Task Force for Identity Theft Victims’ Statement of Rights under federal law: www.idtheft.gov/

The business must provide copies of these records to the victim within 30 days of the victim’s request at no charge. The law also allows the victim to authorize a law enforcement investigator to get access to these records.

- When you have resolved the fraudulent account with the creditor, ask for a letter stating that the company has closed the disputed account and has discharged the debts. Keep this letter in your files. You may need it if the account reappears on your credit report.

- You must also notify the credit bureaus about the fraudulent accounts. Instructions are provided in Section 1

- Check and banking fraud. If you have had checks stolen or bank accounts set up fraudulently, ask your bank to report it to ChexSystems, a consumer reporting agency that compiles reports on checking accounts. Also, place a security alert on your file (see web address below).

Your bank should be able to provide you with a fraud affidavit. Put “stop payments” on any outstanding checks that you are unsure about. Close your checking account and other affected accounts and obtain new account numbers. Give the bank a password for your account (not mother’s maiden name, Social Security number, date of birth, pet’s name, sequential numbers, or any other easily guessed words).

- Phone: (800) 428-9623. Fax: (602) 659-2197

- Web: https://www.consumerdebit.com/consumerinfo/us/en/index.htm

- To place a security alert on your ChexSystems report: https://www.consumerdebit.com/consumerinfo/us/en/chexsystems/theftaffidavit/index.htm Write: ChexSystems Inc., Attn: Consumer Relations, 7805 Hudson Rd., Suite 100, Woodbury, MN 55125.

If your own checks are rejected at stores where you shop, contact the check verification company that the merchant uses. The major ones are listed here.

| Certegy | (800) 237-4851 | www.askcertegy.com |

| SCAN | (800) 262-7771 | www.consumerdebit.com |

| TeleCheck For annual file disclosure Fraud, id theft department |

(800) 366-2425 (800) 835-3243 (800) 710-9898 |

www.telecheck.com |

| CrossCheck | (800) 843-0760 | www.cross-check.com |

You have a right to obtain any reports that these companies compile about you. For ChexSystems and any of the check verification companies listed here that you have had to contact as a result of your identity theft situation, we recommend that you request a copy of your file once a year. Make sure your file has been corrected. If not, you will find it difficult to open new bank accounts and/or write checks. Visit the web sites listed above to learn how to order your free annual reports. And read the PRC’s guide on these “specialty reports.” www.privacyrights.org/fs/fs6b-SpecReports.htm

- ATM cards. If your ATM or debit card has been stolen or compromised, report it immediately. Contact your bank and fill out a fraud affidavit. Get a new card, account number, and password. Do not use your old password. Closely monitor your account statements. You may be liable if the fraud is not reported quickly. Start with a phone call and immediately follow up in writing. Be sure to read the debit card contract for information about liability. Some cards are better protected in cases of fraud than others.

ATM and debit card transactions are subject to the Electronic Fund Transfer Act. (15 USC §1693) Even if you are a victim of identity theft, your liability for charges can increase the longer the crime goes unreported. For more on EFTA, see the FTC’s guide, www.ftc.gov/bcp/edu/pubs/consumer/credit/cre04.shtm. Also read its guide on electronic banking, www.ftc.gov/bcp/edu/pubs/consumer/credit/cre14.shtm

- Brokerage accounts. You do not have the same protections against loss with brokerage accounts as you do with credit and debit card or bank accounts. The Securities Investor Protection Corporation (www.sipc.org ) restores customer funds only when a brokerage firm fails. If an identity thief or other fraudster targets your brokerage account, refer to your account agreement for information on what to do. Immediately report the incident to the brokerage company and notify the Securities and Exchange Commission (www.sec.gov). Also notify the Financial Industry Regulatory Association, (www.finra.org). To protect against fraud, put a password on each of your investment accounts. For more on identity theft involving brokerage accounts, how it can happen, and what to do, see the PRC alert, www.privacyrights.org/ar/BrokerageAlert.htm

- Fraud involving U.S. mail. Notify the local Postal Inspector if you suspect an unauthorized change of your address with the post office or if the U.S mail has been used to commit fraud. Find out where fraudulent credit cards were sent. Notify the local Postmaster to forward all mail in your name to your own address. You may also need to talk with the mail carrier.

Call the U.S. Postal Service to find the nearest Postal Inspector at (800) 275-8777 or visit its web site at http://postalinspectors.uspis.gov/. The online complaint form is available at https://postalinspectors.uspis.gov/forms/MailFraudComplaint.aspx. Or you can mail your complaint to: U.S. Postal Service, Criminal Investigations Service Center, Attn: Mail Fraud, 222 S. Riverside Plaza Suite 1250, Chicago, IL 60606-6100.

- Secret Service. The U.S. Secret Service has jurisdiction over financial fraud. But, based on U.S. Attorney guidelines, it usually does not investigate individual cases unless the dollar amount is high or you are one of many victims of a fraud ring. To interest the Secret Service in your case, you may want to ask the fraud department of the credit card companies and/or banks, as well as the police investigator, to notify the Secret Service agent they work with http://www.secretservice.gov/criminal.shtml.

- Social Security number (SSN) misuse. The Social Security Administration (SSA) does not in most cases provide assistance to identity theft victims. But be sure to contact the SSA Inspector General to report Social Security benefit fraud, employment fraud, or welfare fraud.

- Social Security Administration online complaint form: www.socialsecurity.gov/oig

- SSA fraud hotline: (800) 269-0271

- By mail: SSA Fraud Hotline, P.O. Box 17768, Baltimore, MD 21235

As a last resort, you might try to change your number, although we don’t recommend it except for very serious cases. The SSA will only change the number if you fit their fraud victim criteria. See the Identity Theft Resource Center’s Fact Sheet 113 for more information, http://www.idtheftcenter.org/artman2/publish/v_fact_sheets/Fact_Sheet_113_Social_Security_Number.shtml

If your SSN card has been stolen or lost, order a replacement. Complete the SSA’s application available at www.socialsecurity.gov/online/ss-5.html or by calling the SSA at (800) 772-1213, or by visiting your local SSA office. You will need to provide the required documentation such as birth certificate and government ID at your local SSA office to get a replacement card.

12a. SSN misuse and the IRS. Your SSN can be used fraudulently for tax purposes. For example, an identity thief might use your SSN to file a tax return with the IRS in order to receive a refund. If the tax return is filed before yours, the thief will likely receive the refund. If your SSN has been stolen, it may be used by an imposter to get a job. That person’s employer would report income earned to the IRS using your SSN, making it appear that you did not report all of your income on your tax return. The IRS has established the IRS Identity Protection Specialized Unit to assist individuals with such problems. It can be reached at (800) 908-4490. For more information, visit www.irs.gov/privacy/article/0,,id=186436,00.html.

- Passports. Whether you have a passport or not, write to the passport office to alert them to anyone ordering a passport fraudulently.

- U.S. Dept. of State, Passport Services, Consular Lost/Stolen Passport Section, 1111 19th St., NW, Suite 500, Washington, DC 20036.

- Website: http://travel.state.gov/passport/lost/lost_848.html

- Phone: (877) 487-2778

- Phone service. Identity thieves often establish fraudulent cell phone accounts, with monthly bills going unpaid. The imposter might also have opened local and long distance telephone accounts. If the imposter has obtained phone account(s) in your name, contact the phone company for information on how to report the situation. The steps that you take to clear your name with both the phone company and credit bureaus are much the same as with credit card accounts described above in steps one and three. For AT&T, the fraud hotline is (866) 718-2011.

If your calling card has been stolen or there are fraudulent charges, cancel it and open a new account. For your own phone accounts, add a password that must be used any time your local, cell phone, and long distance accounts are changed.

- Student loans. If an identity thief has obtained a student loan in your name, report it in writing to the school that opened the loan. Request that the account be closed. Also report it to the U.S. Dept. of Education:

- Call: U.S. Dept. of Education Inspector General’s Hotline: (800) MISUSED (800-647-8733)

- Write: Office of Inspector General, U.S. Dept. of Education, 400 Maryland Ave., SW, Washington, DC 20202-1510.

- Web: www.ed.gov/about/offices/list/oig/hotline.html?src=rt

- Driver’s license number misuse. You may need to change your driver’s license number if someone is using yours as ID on bad checks or for other types of fraud. Call the Department of Motor Vehicles (DMV) to see if another license was issued in your name. Put a fraud alert on your license if your state’s DMV provides a fraud alert process. Go to your local DMV to request a new number. Fill out the DMV’s complaint form to begin the investigation process. Send supporting documents with the completed form to the nearest DMV investigation office.

- California DMV fraud unit, www.dmv.ca.gov/consumer/fraud.htm. Phone: (866) 658-5758. Outside Calif.: (916) 657-2274. E-mail: dlfraud@dmv.ca.gov

- The California DMV actually encourages victims to contact them to place “a control” (alert) on their license whenever it is lost or stolen (rather than waiting until they find out it has been misused). It affects only DMV transactions

- DMVs in other states: http://www.usa.gov/Topics/Motor-Vehicles.shtml (scroll down)

- Identity theft involving family members and others you know. If a deceased relative’s information is being used to perpetrate identity theft, or if you personally know the identity thief, additional information about how to address these situations is available in other fact sheets. Visit the Identity Theft Resource Center web site:

- When you know the perpetrator (family member, acquaintance), http://www.idtheftcenter.org/artman2/publish/v_fact_sheets/Fact_Sheet_115_When_

you_personallyknow_the_identity_thief.shtml - ID theft of the deceased, http://www.idtheftcenter.org/artman2/publish/c_guide/Fact_Sheet_117_IDENTITY_THEFT_AND_THE_DECEASED_-_PREVENTION_AND_VICTIM_TIPS.shtml

- Children and ID theft, http://www.idtheftcenter.org/artman2/publish/v_fact_sheets/Fact_Sheet_120.shtml

- Medical identity theft.

Medical identity theft occurs when someone uses your name, Social Security number, or other personal information to obtain health care or medical products. Another variation involves false claims for medical care made to your health insurer, again using your personal information. Like other forms of identity theft, victims of medical identity theft may first become aware of a problem with a call from a debt collector. Medical identity theft can be particularly insidious since remedies involve cleaning up your medical records as well as your credit reports.

For a full discussion of the crime of medical identity theft as well as steps to take if you are a victim, visit the World Privacy Forum’s FAQs for Medical ID Theft Victims and Medical Identity Theft: What to Do if You are a Victim (or are concerned about it).

The Federal Trade Commission has also published medical identity theft guides for consumers and healthcare providers. Visit the FTC’s website:

- Facts for Consumers: http://www.ftc.gov/bcp/edu/pubs/consumer/idtheft/idt10.shtm

- Business Tips for Dealing with Medical Identity Theft: http://www.ftc.gov/opa/2011/02/medicalid.shtm

- FAQ for Health Care Providers and Health Plans: http://business.ftc.gov/documents/bus75-medical-identity-theft-faq-health-care-health-plan

- Victim statements. If the imposter is apprehended by law enforcement and stands trial and/or is sentenced, write a victim impact letter to the judge handling the case. Contact the victim-witness assistance program in your area for further information on how to make your voice heard in the legal proceedings. Read the Identity Theft Resource Center’s Fact Sheet 111, http://www.idtheftcenter.org/artman2/publish/v_fact_sheets/Fact_Sheet_111_Victim_Impact_Statements.shtml

- False civil and criminal judgments. Sometimes victims of identity theft are wrongfully accused of crimes that were committed by the imposter. If you are wrongfully arrested or prosecuted for criminal charges, contact the police department and the court in the jurisdiction of the arrest. Also contact your state’s Department of Justice and the FBI to ask how to clear your name. If a civil judgment is entered in your name for your imposter’s actions, contact the court where the judgment was entered and report that you are a victim of identity theft. For more on what to do if you become the victim of criminal identity theft, see PRC Fact Sheet 17g, www.privacyrights.org/fs/fs17g-CrimIdTheft.htm

- Legal help. You may want to consult an attorney to determine legal action to take against creditors, credit bureaus, and/or debt collectors if they are not cooperative in removing fraudulent entries from your credit report or if negligence is a factor. Call the local Bar Association, a Legal Aid office in your area (for low-income households), or the National Association of Consumer Advocates (www.naca.net) to find an attorney who specializes in consumer law, the Fair Credit Reporting Act, and the Fair Credit Billing Act.

If you are a senior citizen or take care of a dependent adult, be sure to contact an elder law service or the nearest Aging and Independent Services program. Many district attorneys have an elder abuse unit with expertise in financial crimes against seniors.

- Keep good records. In dealing with the authorities and financial companies, keep a log of all conversations, including dates, names, and phone numbers. Note the time you spent and any expenses incurred in case you are able to seek restitution in a later judgment or conviction against the thief. You may be able to obtain tax deductions for theft-related expenses (26 U.S.C. §165(e) — consult your accountant). Confirm all conversations in writing. Send correspondence using certified mail with return receipt requested. Keep copies of all letters and documents.

Visit these web sites for tips on organizing your case:

- FTC’s guide Take Charge, http://www.ftc.gov/bcp/edu/pubs/consumer/idtheft/idt04.pdf

- Identity Theft Resource Center,

http://www.idtheftmostwanted.org/artman2/publish/v_fact_sheets/Fact_Sheet_106_Organizing_Your_Identity_Theft_Case.shtml

- Dealing with emotional stress. Psychological counseling may help you deal with the stress and anxiety commonly experienced by victims. Know that you are not alone. Contact the Identity Theft Resource Center for information on how to network with other victims and deal with the impact of this crime. www.idtheftcenter.org

- Making change. Write to your state and federal legislators. Demand stronger privacy protection and prevention efforts by creditors and credit bureaus.

- Don’t give in. Do not pay any bill or portion of a bill that is a result of fraud. Do not cover any checks that were written or cashed fraudulently. Do not file for bankruptcy. Your credit rating should not be permanently affected. No legal action should be taken against you. If any merchant, financial company or collection agency suggests otherwise, restate your willingness to cooperate, but don’t allow yourself to be coerced into paying fraudulent bills. Report such attempts to government regulators immediately.

- Other Useful Tips

If you are in the military, place an active duty alert on your credit report

When you are away from your usual duty station, you can place an active duty alert on your three credit reports as an extra protection against identity theft. The alert remains on your credit reports for 12 months. Contact the fraud departments for the three credit bureaus. Those phone numbers are provided in Section 1 above.

Order your free credit report

Whether or not you are a victim of identity theft, take advantage of your free annual credit reports, now a requirement of federal law.

- Phone: (877) 322-8228

- Web: www.annualcreditreport.com

- FTC’s guide: http://www.ftc.gov/bcp/edu/microsites/freereports/index.shtml

Opt out of pre-approved offers of credit for all three credit bureaus

- Call (888) 5OPTOUT (888-567-8688). You may choose a five-year opt-out period or permanent opt-out status.

- Or opt-out online, www.optoutprescreen.com

Remove your name from mail marketing lists (Direct Marketing Association)

- Write: Mail Preference Service, P.O. Box 643, Carmel, NY 10512. Include check or money order for $1.

- Web: www.dmachoice.org. There is no charge when registering online.

Remove your phone number(s) from telemarketing lists

- Phone the FTC’s Do Not Call Registry: (888) 382-1222

- Online registration: www.donotcall.gov

- Resources

Federal Trade Commission (FTC)

- Read the FTC’s guide, Taking Charge: What to Do if Your Identity is Stolen, http://www.ftc.gov/bcp/edu/pubs/consumer/idtheft/idt04.pdf.

- Read the FTC’s Identity Theft microsite at http://www.ftc.gov/bcp/edu/microsites/idtheft/.

- Online information and complaint form: www.consumer.gov/idtheft

- FTC uniform fraud affidavit form: www.ftc.gov/bcp/edu/resources/forms/affidavit.pdf

- Identity Theft Hotline: (877) IDTHEFT (877-438-4338)

- Write: FTC Identity Theft Clearinghouse, 600 Pennsylvania Ave. N.W., Washington, DC 20580

President’s Identity Theft Task Force (www.idtheft.gov/)

- Read Identity Theft Victims’ Statement of Rights, www.ftc.gov/bcp/edu/microsites/idtheft/consumers/rights.html

- Read publication, “Taking Action,” for information on what federal government agencies are doing to combat identity theft, www.idtheft.gov/takeaction.html

Federal Agencies and Technology Industry

- For tips on online safety, visit www.onguardonline.gov

Identity Theft Resource Center (ITRC)

- Guides for victims, www.idtheftcenter.org (Click on Victim Resources.)

- Phone: (888) 400-5530

- Web: www.idtheftcenter.org

- E-mail: itrc@idtheftcenter.org

- Write: P.O. Box 26833, San Diego, CA 92196

California Department of Justice’s Privacy Enforcement and Protection Unit

- Web: http://www.oag.ca.gov/privacy

- ID theft guides: http://www.oag.ca.gov/idtheft/information-sheets

Identity Theft Survival Kit

- Mari Frank, Esq., author of From Victim to Victor: A Step-by-Step Guide for Ending the Nightmare of Identity Theft and Safeguard Your Identity: Protect Yourself with a Personal Privacy Audit

- Web: www.identitytheft.org

- Phone: (800) 725-0807

U.S. Dept. of Justice. The DOJ prosecutes federal identity theft cases.

FBI Internet Fraud Complaint Center. The Internet Crime Complaint Center (IC3), a partnership between the FBI and the National White Collar Crime Center, allows you to report suspected cases of Internet and e-commerce fraud, including phishing.

- Web: www.ic3.gov

This guide was originally written as a joint project of the Privacy Rights Clearinghouse (www.privacyrights.org) and CALPIRG (www.calpirg.org). Both are nonprofit consumer advocacy organizations. We thank Linda Foley of the Identity Theft Resource Center and Mari Frank, Esq. for their assistance.

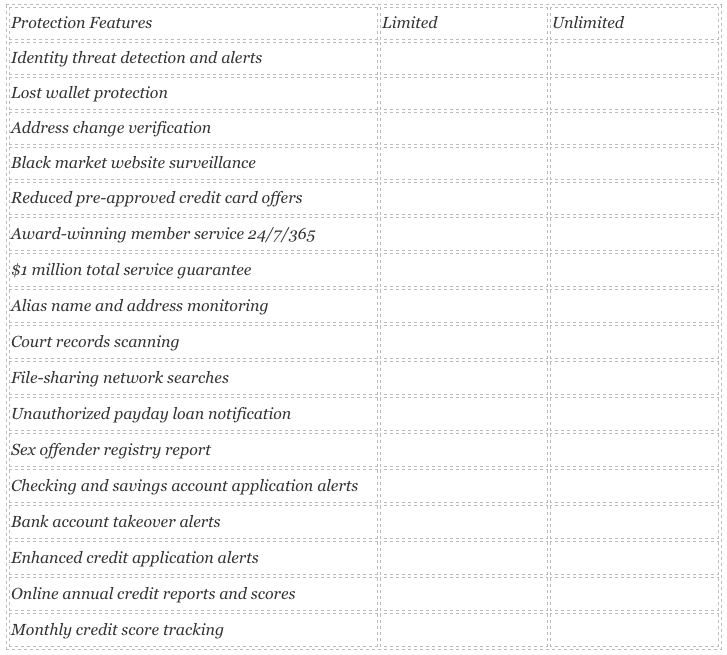

Instead of just hoping for the best, let us protect you from the worst. Choose the level of protection that’s right for you and your family.